Investing in the

Micro Business Revolution

for Exponential Returns

Wayne Van Dyck

Wayne is the founder and chief architect behind Micro Biz Studio. His career has taken him from Wall Street to some pretty unexpected places.

He started out as an investment banker and venture capitalist, then built LA’s #2 rock station as founder of Cosmic Communications. He launched Windfarms Ltd. and partnered with Chevron to develop wind energy for utilities. He brought digital telecom to Moscow for the first time, leading the San Francisco-Moscow Teleport in partnership with GTE.

Wayne founded four software companies as an internet entrepreneur, then teamed up with Siemens to create the first digital investment bank focused on clean energy project finance. These days, he’s building a portfolio of micro businesses—and having a great time doing it.

Chris Coldwell

Chris is a very experienced software architect/developer. With two degrees in computer science, he has held various senior management positions at Mercurial Communication, Pacifici Rim Technologies and Three Trees Technical. As the founder and CEO of Quicksilver Software Development he built a team of over 100 engineers and developers. Today he specializes in developing complex AI and automation solutions for small and mid-size businesses.

The New World of Micro Business

Micro-businesses are lean digital ventures — often just one or two people —powered by AI no-code tools and AI agentic automation. They exist because AI has made it cheap and easy to start and scale without venture funding, big teams or expensive infrastructures. With drag-and-drop software, automated workflows and AI assistants, anyone can test ideas, launch real products, reach worldwide markets and grow multi-million-dollar businesses. Micro businesses are creating a new wave of entrepreneurs — solopreneurs, side-hustlers, and retirees.

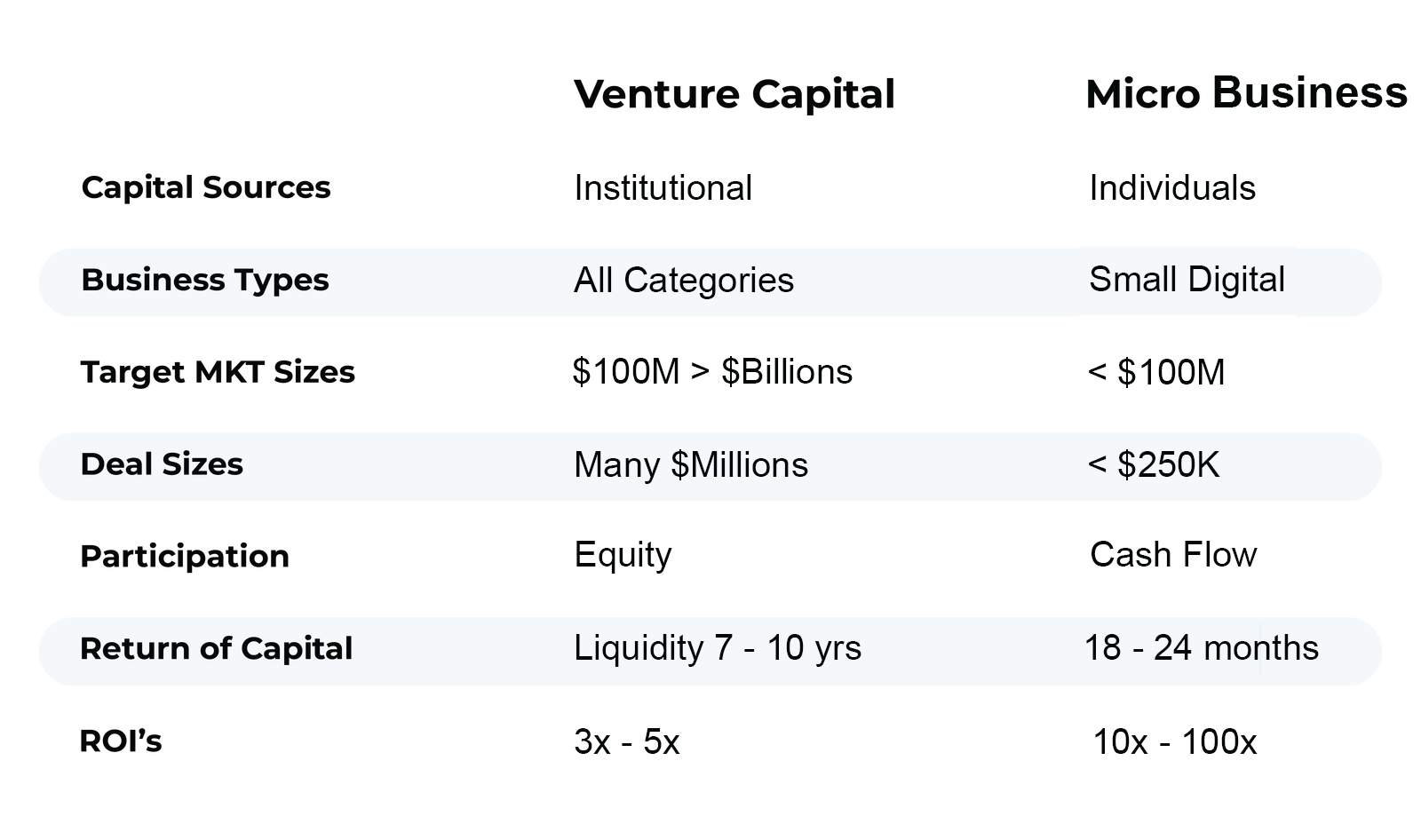

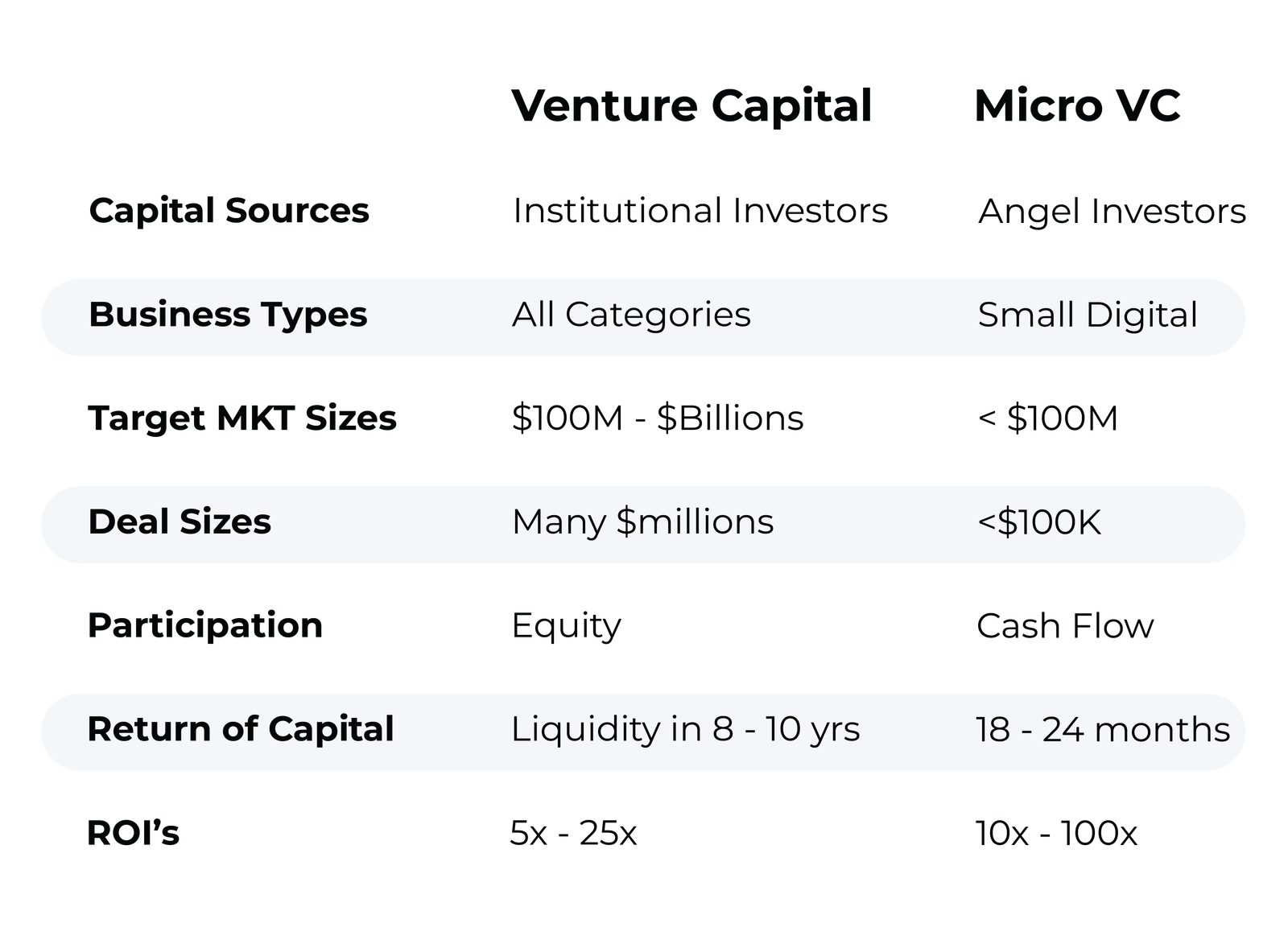

Micro Business compared to Venture Capital

Investing in micro digital business is completely different than traditional venture capital. The following chart highlights the major differences.

Exponential Returns

Micro-businesses are extremely capital effiicient — perfect for individuals looking for big upside without the big checks. Unlike traditional startups that burn through millions over multiple funding rounds, a micro-business can be launched with less than $250,000. And thanks to automation, almost zero distribution costs and high profit margins, they scale fast and can fund their own growth. The result? Lower risk, higher leverage, and the potential for exceptional returns for fortunate investors.

Our Investor Model

In traditional venture investing, early-stage individual investors purchase shares in a corporate entity. These shares usually get highly diluted through many rounds of financings. In the micro business world, most ventures are not put into a corporate form, thus there are no shares to sell. When a micro-business needs financing, the investors are given a participation in the revenues and the sale of the venture. Normally there is no additional dilution as micro businesses rarely have multiple rounds of financings. Since most micro businesses have only one round of financing and if they grow into multi-million dollar ventures, the ROI’s can be very high.